riverside county sales tax calculator

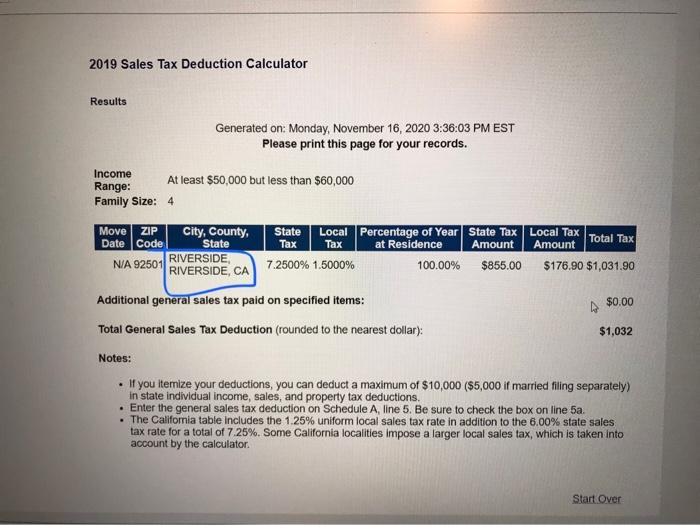

The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax a. 0275 0385 san.

Washington Sales Tax Rates By City County 2022

The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15.

. The sales tax rate for Riverside County was updated for the 2020 tax year this is the current sales tax rate we are using in the. The December 2020 total local sales tax rate was also 7750. Median home values vary widely in.

The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce. Riverside County Property Tax Rates. For comparison the median home value in Riverside County is.

This is the total of state and county sales tax rates. The latest sales tax rate for Desert Center CA. Sales Tax Table For Riverside County California.

The minimum combined 2022 sales tax rate for Riverside County California is. For a list of your current and historical rates go to the california city county sales use tax rates webpage. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

The current total local sales tax rate in Riverside County CA is 7750. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county. Method to calculate Riverside sales tax in 2022.

Sales tax in Riverside County California is currently 775. Riverside Countys average effective tax rate of 110 is the second-highest in the state of California after Kern County. Method to calculate Riverside County sales tax in 2021.

This includes the rates on the state county city and special levels. Riverside County Sales Tax Rates for 2022. The base sales tax in California is 725.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 832 in Riverside County. This rate includes any state county city and local sales taxes. Welcome to the Riverside County Property Tax Portal.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 2020 rates included for use while preparing your income tax deduction. Riverside County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in.

What is the sales tax rate in Riverside County. 075 lower than the maximum sales tax in CA. Sales Tax Calculator Riverside Ca TAXW from.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Riverside is located within Riverside County.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Choose Avalara sales tax rate tables by state or look up individual rates by address. The average cumulative sales tax rate in Riverside California is 863.

The local sales tax rate in Riverside County is 025 and the maximum rate including California and city sales taxes is 1025 as of October 2022. Choose city or other locality from Riverside.

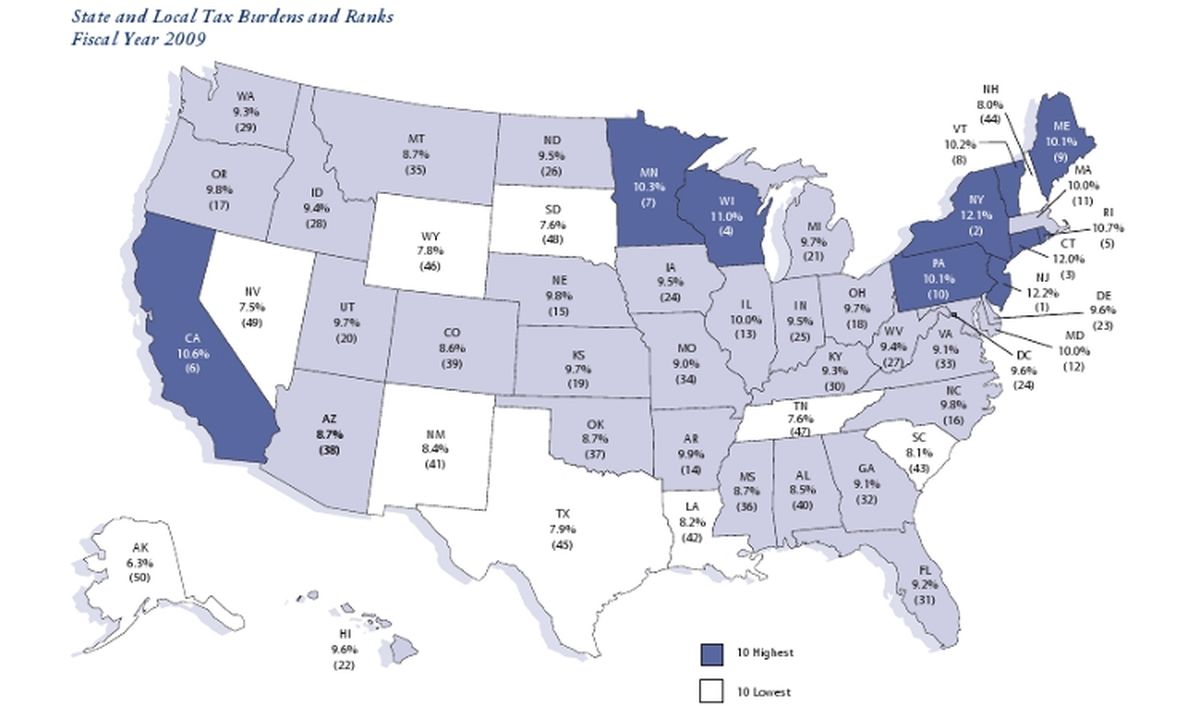

State Taxes On Your Mind Let S Compare Idaho Vs Washington In Total Tax Burden The Spokesman Review

California Sales Tax Calculator Reverse Sales Dremployee

Greater Dayton Communities Tax Comparison Information

California Used Car Sales Tax Fees 2020 Everquote

Are There Any States With No Property Tax In 2022 Free Investor Guide

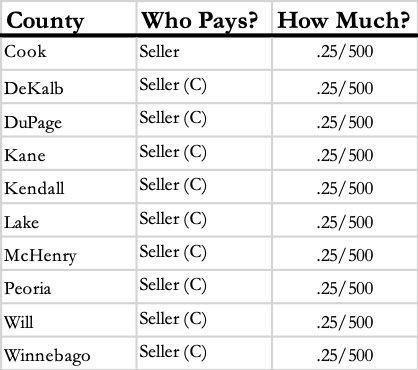

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

California Sales Tax Rate Rates Calculator Avalara

.jpg)

Bid4assets Riverside County California Tax Sale Information

1 125 Sales Tax Calculator Template

Solved For This Question What Are All The Scheules And Forms Chegg Com

How To Calculate California Sales Tax 11 Steps With Pictures

Food And Sales Tax 2020 In California Heather

California Sales Tax Guide For Businesses

California Sales Tax Small Business Guide Truic

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

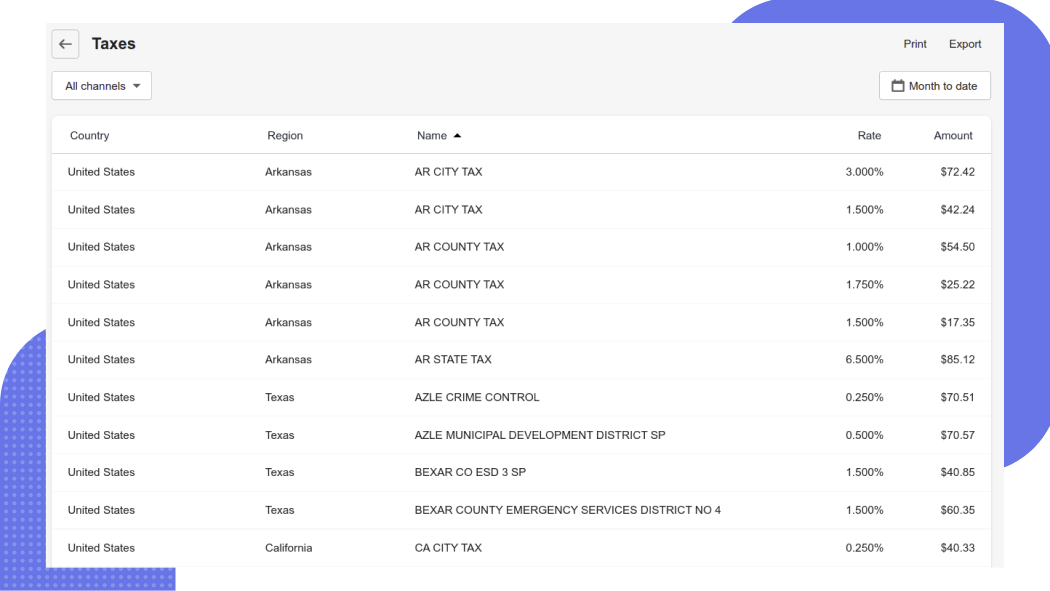

Shopify Sales Tax Report Step By Step Guide Self Service Bi Reporting Platform

Sales Tax Calculator And Rate Lookup Tool Avalara

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop